Let’s start with a warm-up exercise. Here are phrases you might find in any project meeting. Insert the missing words.

“The easiest way to start this project is to pick the [insert adjective] fruit.”

“That process is too convoluted. The shortest distance between Point A and Point B is a [insert adjective][insert noun].”

“We need to modernize, but the metrics don’t support a complete platform change. We’re stuck between a [insert noun] and a [insert adjective][insert noun].

“Our competitors are going digital and they’re using it for [insert anything here]. They just partnered with [insert company] and now they are serving the [insert market] with their new [insert product].”

It might be an oversimplification, but insurance company growth lately is more about filling in gaps and blanks — capturing new or open opportunities with new products, partners and channels . Because risk management is the core of insurance, most insurers are very adept at managing risk to ensure underwriting profitability and customer satisfaction. Digital technologies and greater real-time data access are both steadily advancing risk management expertise, while also helping customers reduce or mitigate risk.

It’s what’s missing in the technology/market mix that counts. Some organizations need to extend their expertise in filling market gaps and in using new technologies and partnerships to jump forward into new, open opportunities.

Majesco’s research uncovered this insightful detail: When insurance Leaders realize that they are missing a key component of their strategy, the blank gets filled in quickly. They shift seamlessly from knowing and planning into doing. They actively fill competitive gaps and when opportunity creates an opening, they jump into it. This ability to jump into it, defines the difference between Leaders, Followers and Laggards in this report, Strategic Priorities 2021: Despite Challenges, Leaders Widen the Gap. We will look at some of these insights today.

Monitoring Gaps Highlights Competitive Discrepancies

Insurers’ competitive positioning used to be a brand and distribution focus. Now, distribution and the business are looking to technology, platforms and partnerships to give them a competitive edge. That edge, however, is shifting. Leaders are widening the gap with Followers and Laggards in several key areas.

When it comes to incorporating specific marketplace trends, technologies or capabilities into their business models or offerings, Laggards continue to fall further behind both Leaders and Followers. Their focus is on a very limited set of opportunities that do not even keep pace with the rest of the industry.

The Majesco survey asked companies to indicate their level of response, from “No focus on this” to “Already implemented,” for specific items within these categories:

- ecosystems

- Regulatory developments

While companies cannot act on all of these issues at once, the inability to move from understanding to planning and execution is of increasing concern given the pace of change in the marketplace. Companies that fail to incorporate these categories into their plans and execute on them are intensifying their operational and business risk.

Responding to New Market Opportunities

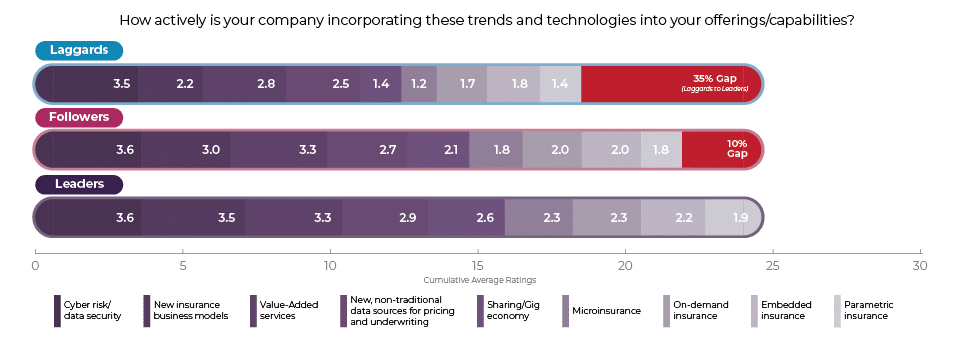

Continuous changes in technology-driven capabilities, customer behaviors and expectations and blurring market boundaries have created numerous opportunities for insurers to grow by creating new products and services and reaching new markets. Followers and Leaders are fairly well aligned on their cumulative responses to the market opportunities created by these trends.

However, there is a sizable overall gap (35%) between Leaders and Laggards, led by enormous gaps in acting on Microinsurance (92%) and the Sharing/Gig Economy (86%), and developing New Insurance Business Models (59%). These topics were not covered in the 2018-19 survey but in the 2019-20 survey, the gap between Leaders and Laggards was 22% and 7% for Leaders vs. Followers – reflecting a large increase in the Leader – Laggard gap. Again, this supports the observation that Followers are doing their best to keep close to Leaders, but Laggards falling further behind.

Figure 1: Gaps between Leaders, Followers and Laggards in responses to market trends

Leveraging Platform Technologies

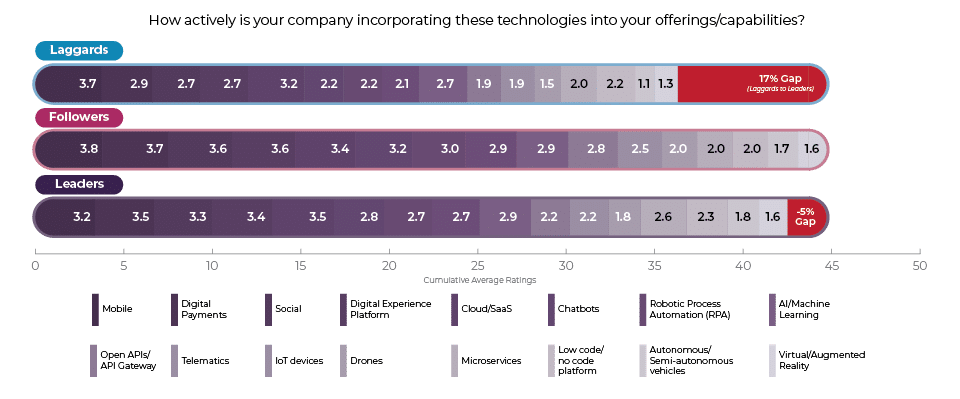

The most unexpected finding in this year’s survey was that Followers beat the Leaders in their cumulative levels of incorporating 16 different technologies into their offerings or capabilities. Although a small gap, just 5%, it represents a 17-point swing from last year, when Leaders held a 12% advantage. We hope this continues into next year, putting Followers in a much better position to compete!

The gap between Leaders and Laggards remained relatively the same, at 15% last year and 17% this year.

Figure 2: Gaps between Leaders, Followers and Laggards in responses to technology trends

When we split these 16 technologies into three cohesive groups and compared the aggregate averages, you see that the Leader-Follower gap is driven by Technologies for Products and Services (11%) and Customer Experience Technologies (9%). While not large, these topics are top of mind for leading, innovative insurers who are focused on the next generation of customers who demand different products and experiences.

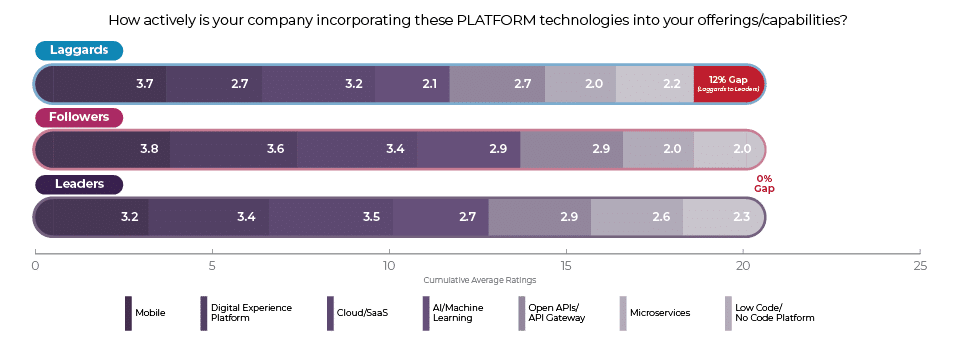

Leaders and Followers are dead even in their overall levels of activity and response to Platform Technologies, improving from a 15% gap in favor of the Leaders last year. Even more encouraging, Laggards nearly halved their gap with Leaders, from 22% last year to 12% this year. Leaders and Followers separate themselves from Laggards on two of the technologies: Digital Experience Platform (26%, 33%) and AI/Machine Learning (29%, 38%) while Leaders stand out from both on Microservices (30%).

The tightening of the gaps between all three is overall encouraging, particularly for Followers and Laggards, giving a ray of hope. Reality appears to be sinking in that we are shifting to a new era of platform technologies.

Figure 3: Gaps between Leaders, Followers and Laggards in responses to platform technology trends

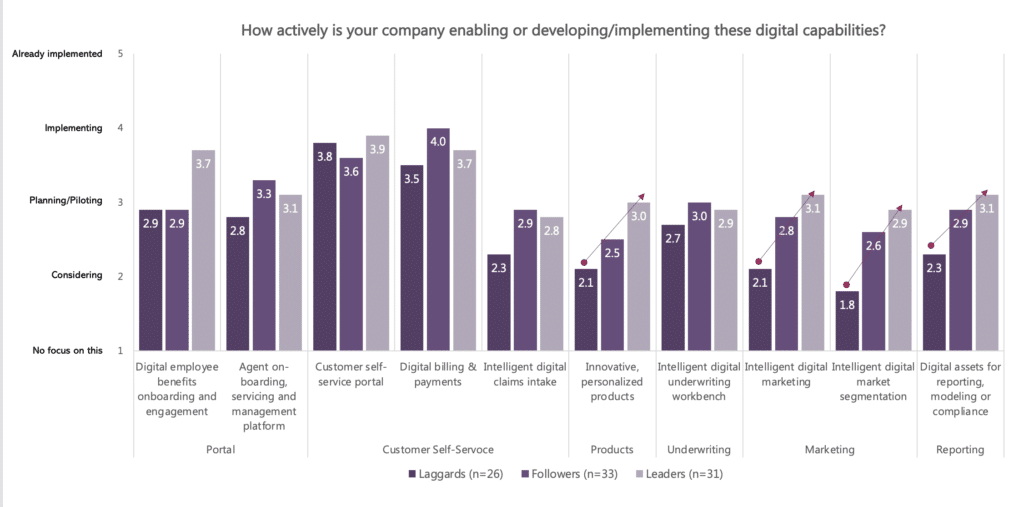

Implementing Digital Capabilities

This years’ area of specific focus was around digital capabilities and the results definitively highlight that this is the era and year of digital! All three segments are implementing digital self-service options like chat and digital payments. While these tools have been around for some time, COVID made them table stakes.

These tools – while helpful and used by many “out of the box” portals as functional apps, like a claims app – do not in themselves meet the shift and customer expectation of personalized, holistic experiences. This is where digital insurance platforms, a combination of digital experience and low code/no code platforms, transform these older approaches from siloed, separate transactions into next-gen satisfying, holistic experiences for customers, channel partners and employees, as we noted in our life and auto customer research.

Neither is it sufficient to simply add common, disparate digital capabilities like portals and think you can “check the digital box.” Becoming a digital insurer requires a cultural change and mind shift to a new way of thinking, planning, and doing. Leaders know this. They are using digital everywhere it counts.

Digital leaders are leveraging digital technologies to enhance customer and employee experiences and to improve their strategic and operational capabilities, as seen in Figure 4, with leads over the Laggards in Digital employee benefits onboarding and engagement (28%), Intelligent digital claims intake (22%) Innovative, personalized products (43%), Intelligent digital marketing (48%) and segmentation (61%), and Digital assets for reporting, modeling or compliance (35%).

Today’s customers are increasingly digitally adept, with higher expectations, different needs and a demand for better experiences that are not met with the “traditional” insurance approach, creating a fault line between customers’ expectations and insurers’ ability to deliver. These digital gaps will become the new competitive differentiators.

Figure 4: Leaders, Followers and Laggards responses to developing/implementing digital capabilities

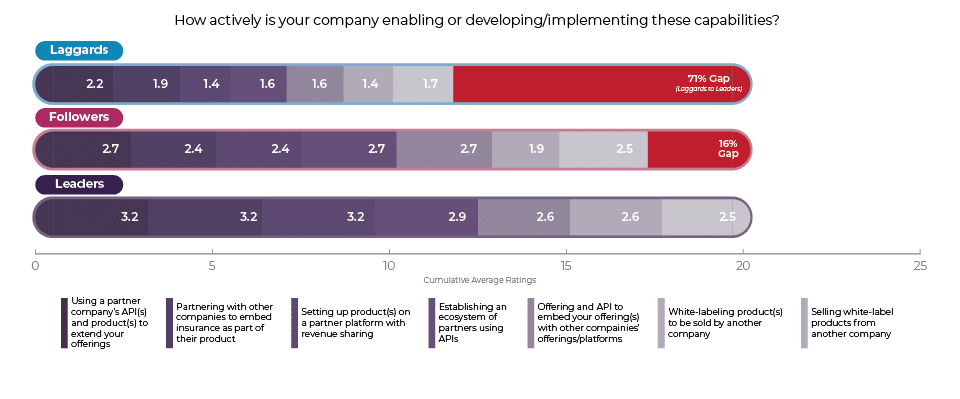

Partnerships and Ecosystems

The gap between Leaders and Laggards was the greatest for Partnerships and Ecosystems, at 71%. The largest drivers of this disappointing and concerning gap are Setting up product(s) on a partner platform with revenue sharing (129%), White-labeling product(s) to be sold by another company (86%), and Establishing an ecosystem of partners using APIs (81%).

Insurers must increase their “doing” in this area to avoid lost opportunities to reach new or underserved markets and to be at the forefront in establishing partnerships before others. We highlighted this opportunity in our joint research with PIMA last year. Laggards’ failure to recognize the criticality of partnerships and ecosystems is a major blind spot.

Our research, as well as numerous other studies, have shown strong customer interest in buying insurance through other partnerships and channels. Furthermore, the development and access to APIs to connect to new partnerships and ecosystems is increasingly important to be considered.

In this new era of insurance, nearly every insurance process is rapidly becoming frictionless, including buying. If distribution channels are easy to use with products that are easy to understand, then insurance has the opportunity to grow through a friction-free, multi-channel distribution system. The benefit of adapting to these channel dynamics is that we move from needing to “sell” people on purchasing insurance, to introducing insurance that is ready to be “bought” seamlessly at the point of need, creating a scale-able, sustainable business model.

Figure 1: Gaps between Leaders, Followers and Laggards in responses to partnerships & ecosystems

While both Laggards and Followers closed the gap with the Leaders last year, each saw those advantages disappear this year. The Leader-Laggard gap was a staggering 4x increase over last year’s gap of 18% and the Leader-Follower gap increased 3x. This does not bode well for both Followers and Laggards – limiting their market reach and growth.

Market boundaries are no longer clear. They are shifting and, in some cases, evaporating. The combination of technology and customer expectations is directly impacting insurance by altering the traditional ecosystem of agents and brokers – who, yes, are still relevant – to have insurance embedded or sold differently across a broader ecosystem including automotive, transportation businesses, big tech and more.

By doing so, these partners are breaking down business and market boundaries to make the ecosystems operate fluidly, based on the customer’s needs and expectations for both the risk product and other value-added services. This, in turn, creates greater value for these insurers due to new revenue streams and access to a broader market through the multiplier effect.

Given the rapid development of ecosystems, shift to a platform economy, and increased focus on a broader customer experience dependent on partnerships, these gaps offer Leaders, who are actively working with ecosystems and partnerships, the opportunity to accelerate and tie down relationships while Laggards and Followers get left behind.

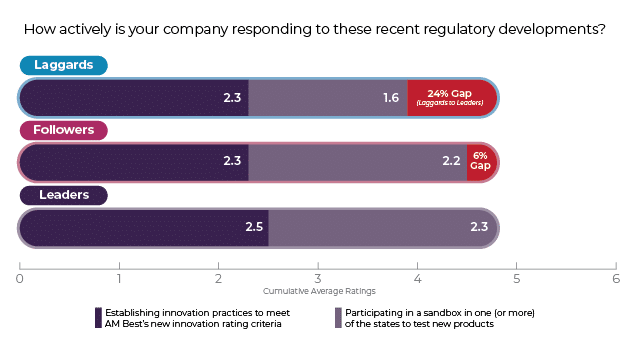

Using Regulatory Scoring to Push Transformation Agendas Forward

Within every insurer, there are those who wish to move faster than the company traditionally moves. It’s a frustrating position to be in. For transformation-minded executives who find themselves in the Follower or Laggard categories, it might be helpful to document all of the potential value and incentives that your organization stands to gain. One of the incentives on the list must be to improve their ratings standing with AM Best.

Compared to the other Doing categories, responding to the AM Best innovation rating criteria and participating in a state-sponsored innovation sandbox have among the lowest levels of activity by all three segments. The 24% Leader-Laggard gap increased slightly from last year’s 17% gap, while the Leader-Follower gap remained flat compared to last year’s 7% gap.

Innovation initiatives are increasingly laser-focused on creating competitive advantages that respond to the rapidly shifting marketplace and adoption of digital technology. As a result, innovation has moved from an operational to a strategic imperative in order to solidify market leadership by outpacing competitors, and by challenging disruptors to ensure long-term survival and success. From this viewpoint, it is surprising that insurers are not more actively planning or executing strategies that take advantage of these regulatory changes to accelerate their innovation initiatives.

We believe the “knowing-doing” gap and the paths an insurer takes for the future, including leveraging the sandbox opportunities, will have a direct relationship with their innovation capacity and ability, two crucial elements of the new AM Best innovation score. Forward-focused insurers should use this pressure to their advantage.

Figure 6: Gaps between Leaders, Followers and Laggards in responses to regulatory innovation developments

When it comes to opportunities, insurers, even Laggards, should remain optimistic. It isn’t too late to take advantage of the technologies, platforms, partnerships and regulatory stimulants that can move your organization into the future.

COVID-19 has been a global crisis, but it has also given insurers new opportunities for the post-pandemic market. Is your organization using this time of crisis as a wake-up call to position your company for the future? How would you fill in the gap and space?

In our next blog, we look at the role of optimism within a strategy for growth. What are companies like yours considering for the next three years? Can it help to look at the complete industry with different eyes? Be sure to get the complete picture by reading, Strategic Priorities 2021: Despite Challenges, Leaders Widen the Gap.

The post Insurance Leaders Use Digital for [Insert Anything Here] appeared first on Majesco.

from Majesco https://ift.tt/3vZRvJG

Post a Comment

Post a Comment