Baseball is a game of tradition. For fans it offers the emotions of great plays, outstanding pitching and the thrill of home runs sailing over an outfield fence. Just because baseball has a firm tradition, however, doesn’t mean that baseball operations have stayed traditional. For players and coaches, the game is about skill and analytics. When you uncover baseball’s core, winning is now about improved data and better use of data sources. Don’t believe it? Take a look at two late-season events from the major leagues in 2021.

First, there is the strange case of the St. Louis Cardinals. The Cardinals didn’t have their best year, but by most measurements, it would’ve been considered a success. They finished the season at 90-72 and landed themselves in a Wild Card spot. They had a 17-game winning streak in September. Yet, in a surprise move, shortly after their last game, the Cardinals’ front office released their manager for “philosophical differences.” At least one of those differences was the manager’s resistance to the full use of analytics. Who would have envisioned a day when data usage would be a such a powerful managerial litmus test that it could remove a winning manager?

Then, there is the case of Houston Astros catcher, Martin Maldonado. Maldonado is one of the worst hitters in baseball, yet he is by far one of the league’s best catchers. Though only hitting .172 during the regular season, he was re-signed to a $5 million contract through 2022 and many consider him to be the most valuable player on the team.[i] Why? Maldonado is the king of analysis. He studies every batter. He briefs every pitcher. He uses the numbers to change the game. Tomorrow, his team will start Game 3 of the World Series, partly because of his attention to analytics.

Like baseball of the past, Group and Voluntary Benefits could be played passably-well with a couple of common data sources, some technology and a lot of knowledge, wisdom and experience. But with both, today’s insurance and today’s baseball, high-level performance requires going to the next level to put together a competitive combination of players, data and tools. Today’s and tomorrow’s Group and Voluntary Benefits products and services will require optimized operations, next-gen technology and cutting-edge analytics. These will help insurers to Build their own Field of Insurance Dreams.

Last week, we released The New Reality and Future of Group and Voluntary Benefits, a thought-leadership jointly authored by Majesco and Deloitte insurance experts. In the report, we look at the current state of Group and Voluntary benefits through the lens of both Majesco and Deloitte research as well as recent joint round-table discussions with leading Group and Voluntary Benefits insurers – and even a buyer of benefits! We then look specifically at the Voice of the Market Players — employers, employees and brokers. We round out the picture with the Future State of Group and Voluntary Benefits that will require new strategies, new products, new operating models and a new approach to technology.

In today’s blog, we’ll assess what the report has to say about the current state. Are Group and Voluntary Benefits insurers running in the right direction?

Insurance spending — predictive or reactive?

Majesco’s 2021 Strategic Priorities research, based on post-COVID insurer survey results, reflected a rapidly widening gap between Leaders vs. Followers and Laggards when looking at their focus on key strategic initiatives in the past year and the next three years. However, there is the potential promise of change. In Deloitte’s Midyear 2021 US Insurance Outlook survey and report, even though 52% of respondents trimmed discretionary spending, often in areas such as talent acquisition, only 6% cancelled or postponed long-term technology projects, while 96% are accelerating digital transformation initiatives to deal with a “new normal.”[ii]

Furthermore, the top two activities prioritized by insurers to support financial and operational stability over the next 6–12 months involved implementation of new technology. The first, enhance efficiency (70%) and the second, improve customer experience (68%) prove that insurers are looking to technology to operate profitably across all functions. Furthermore, insurers are fueling more aggressive technology investment, with 68% of those surveyed planning to increase spending on data analytics and 59% increasing investment on artificial intelligence (compared to 40% in Deloitte’s last survey).

Spending tells a story. Insurers recognize that they must improve efficiency to control overall operations. It’s a reactive solution, but it’s necessary. Group and voluntary benefits insurers are seeing industry shifts and they are predicting their own outcomes. This has increased the focus on transforming legacy core with cloud-based next gen core designed to enable new business operating models and digitize capabilities. They realize that the employer and employee experience is going to be the measurement standard by which they will succeed. Can they become a dream insurer by giving employers what they need — non-traditional, API-enabled, non-constrained products that give data back as they use analytics properly?

Success in the future will be highly dependent on these key areas:

- Customer-first focus

- Business operating model transformation

- Innovative new products and services that meet the needs of multiple generations and diverse employee and employer segments

- Embracing next-gen core, data, digital and ecosystems

- Continuous innovation as the market landscape continues to change

Strategy development that matches the real Group and Voluntary landscape

The primary challenge Group and Voluntary Benefits providers have is dealing with significant legacy debt in terms of old operating models underpinned by multiple legacy core systems, technology architectures, and archaic business processes. These core challenges hinder their ability to execute on a profitable growth strategy, improve operationally, rapidly respond to market opportunities, and innovate with new products and services, let alone have a customer-centric view.

In many cases, insurers lack a comprehensive strategic response that balances today’s business with the rapidly shifting expectations of market forces at play. Changes in buying behaviors, the regulatory landscape, the competitive landscape, innovation, and the underpinnings of legacy technology and architecture can make any strategy’s foundation seem unstable. The generational shift in customer preferences, plus the employers’ desire to shift cost/risk to employees, is increasing the focus and demand for cooperative partnerships across the ecosystem players to enable personalized, digital and omni-channel services.

In our recent roundtables with Group & Voluntary leaders, topics like enabling a true end-to-end digital experience during sales, ecosystem connectivity through APIs, claims and leave transformation, improving speed to market for new product launch, and automation of sales-related operational tasks were identified as top-of-mind challenges and imperatives. With all of these considerations on the table, Group and Voluntary strategies seem to be running toward reality; executives understand the possibilities and they are strategizing to meet the market.

Traditional products — One-size fits one group. What about the other groups?

The efficiency and profitability of Group and Voluntary products has been, until now, their bulk nature. Brokers could say, “We don’t need names. We don’t data. We just need to know how many takers you have in the company. Send us the premium. Your employees are covered.”

Traditional products focused on life, accident, disability, medical, dental and A&H, lack innovation and answers for new needs and expectations, particularly for Millennials and Gen Z. Most plans were developed as a one-size-fits-all rather than recognizing the need for variations of plans to meet a diverse multi-generational employee base. There may be four or five more demographic segments with widely-divergent needs.

Employers and employees are looking for products and services that are more affordable, tailored to very specific needs, portable, digital-first, simpler, and grounded in trust. They want all of the services that will help employees manage their lives and employment. Employees like the idea of account-based benefits that may (or may not) be subsidized by their employer, but that are ultimately theirs to use, save or move with them. Some employees want only catastrophic coverage. Others want full coverage. Still others want coverage for or assistance with totally new needs, like pet insurance or student loan repayment. One-size fits all is giving way to “build-your-own” coverage. Even the enrollment tools have had to change to allow for digital enrollment with options on top of options, as well as suggesting options based on where they are in their life journey.

The only way Group and Voluntary providers will fit the new molds will be to reconfigure for flexibility. The reality of today’s new benefits landscape is that only those with a framework for innovation will be able to stay in the league of play. This means that the most important strategy for any company will be the adoption of a next-gen framework.

Group and Voluntary segments are shifting to next-gen technologies

The Group and Voluntary Benefit market segment has been behind in legacy modernization due to the complexity, cost and difficulty of replacement, given that many policies on the systems can be from 30 – 50+ years old. A large number of these insurers have complex, aging infrastructures.

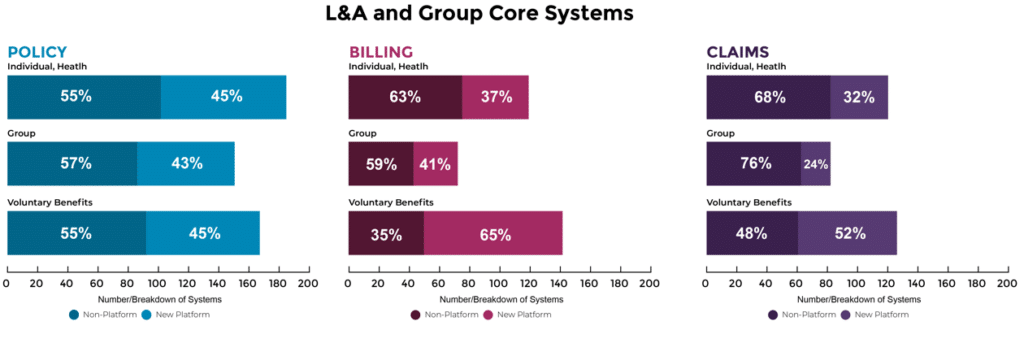

Based on Majesco’s 2020 Core Systems research, overwhelmingly, L&A and Group are operating with non-platform solutions at 50-75%, as represented in Figure 1.[iii] A staggering 40-75% have either 2-5 or over 6 policy systems, representing a significant legacy challenge. Both true Group and Voluntary benefits are challenged with non-platform core solutions, putting insurers at a significant disadvantage to adapt, innovate and accelerate growth.

However, Group and Voluntary Benefits providers are on the move. According to Majesco research, voluntary benefits represents the strongest shift to platform-based solutions among all insurer types. This is not surprising given the significant market interest and growth in voluntary benefits due to changing employee demographics, more job movement, and the desire for innovative new benefits and portability.

Figure 1: Status of L&A and Group Core Systems

Data-fueled analysis will make the difference

The importance of capturing, enriching, and using data for delivering a relevant and engaging customer experience is paramount, even for Group and Voluntary Benefits. The opportunity to combine employer data with employee-generated data provides a foundation to create personalized experiences and tailored offerings that can drive increased and broader enrollment in benefits and improve customer loyalty.

One of our round-table participants said it best,

“Everything is driven by the data. If you don’t have a good data model, it’s going to be difficult to achieve success. Data is crucial for digital and customer experiences.”

Every digital or customer-focused business process and solution is ripe for embedded analytics. Structured, unstructured, transactional, real-time and third-party data across the Group and Voluntary benefits ecosystem can be used to drive innovative data-led propositions, improved underwriting and claims, and ultimately enhanced customer experience. This is a mandate, not an option.

To succeed in the future of insurance, insurers must prioritize and address their technology foundation to drive digital transformation, innovation, and growth. That’s the current state of the Group and Voluntary market — the need for transformation by traditional players, the opportunity for real growth and the excitement of a strategic plan that will produce a winning team.

In my next blog, we’ll look at the future of the Group and Voluntary Benefits market. How and what are these new strategies going to effectively supply the market with what it’s looking for? Which products are the most likely to grow in use and interest among employers and employees? For a preview, be sure to read, The New Reality and Future of Group and Voluntary Benefits. For a data-specific view on how usage and analytics is shifting across the entire insurance value chain, be sure to view our most recent webinar, Insurance Moneyball: Winning in the Digital Age of Insurance.

Co-authors:

Abhishek Bakre, Senior Manager, Strategy and Financial Services at Deloitte Consulting LLP, Denise Garth, Chief Strategy Officer at Majesco

[i] Wagner, James, “The Astros’ Secret Weapon? A Catcher Who Hit .172,” New York Times, October 26, 2021.

[ii] Shaw, Gary, “Midyear 2021 US insurance outlook: Most carriers primed for growth as economy rebounds,” July 27, 2021, https://www2.deloitte.com/us/en/insights/industry/financial-services/impact-of-pandemic-insurance-industry.html

[iii] Garth, Denise, “Insurance Digital Transformation: A New Era of Core Systems, Next Gen Technologies and Ecosystems,” Majesco, March 13, 2020, https://www.majesco.com/white-papers/insurance-digital-transformation-a-new-era-of-core-systems-next-gen-technologies-and-ecosystems/

The post Running Toward Reality: Overcoming Traditional Group and Voluntary Strategies appeared first on Majesco.

from Majesco https://ift.tt/3vVoIWR

Post a Comment

Post a Comment