It was 1999 and everything about business was changing. The Internet was hot and growing! Ebay and Amazon launched within the previous 4 years. Napster debuted the peer to peer music file sharing network – the precursor to iTunes. It was all about e-business!

Fast Company magazine was putting out 300-page monthly issues that covered the most innovative companies and people imaginable. Every time you turned a corner, you found a new Starbucks that you hadn’t seen before. Apple had just created berry-colored, egg-shaped computers called iMacs. The economy was hot. IT departments were busy with Y2K preparations. The future was coming fast and furious! Could life get any better?

With all of the optimism for the future in the air, the time was ripe for people to “discover their working selves.” Two Gallop researchers, Marcus Buckingham and Curt Coffman wrote a managerial book, First, Break All the Rules, that had us thinking about how to do things differently using our individual strengths. They used interviews with over 80,000 employees to identify practical insights regarding managers. Some of the insights for individuals and managers are highly relevant when carried to insurers and systems. For example, in their chapter on How to Manage Around a Weakness, they discuss how managers can devise a support system that keeps an individual’s strengths operational while rendering their weaknesses irrelevant.[i] The exact same principles can be applied to insurers who find themselves with weaknesses that seem to be rendering their strengths ineffective. There are support systems that can make those weaknesses irrelevant.

In a 2001 follow-up book, Now, Discover Your Strengths, Buckingham and former Gallup chair, Donald O. Clifton, built on that idea by helping individuals identify their strengths so that they could focus on what they do well. This concept also works well in the macro sense for insurers. How well an insurer knows its strengths and weaknesses will determine its ability to proactively and aggressively make the right strategic and operational moves.

If we think about what has transpired the last twelve months during the COVID-19 crisis, we see a pattern emerge that is crucial for insurers to re-visit.

- There is great new and existing opportunity in the COVID and Post-COVID economy.

- Insurers need to know their organizations well enough to know whether or not they are prepared to take advantage of the opportunities. They need to know which strengths and talents that they are missing and which ones they have firmly in hand.

- They need to focus on their strengths while they seek assistance from others to shore up weaknesses.

- They need metrics. They need to pursue continuous evaluation of where they are against competitors because that landscape is constantly shifting. They need to know: “Are we Leaders, Followers or Laggards?” They need to use that position, no matter what it is, as inspiration to move forward.

For the past five years, Majesco has been helping insurers look in the mirror and to gauge their efforts in light of the marketplace shifts and trends and other insurance organizations. In what ways are these companies leading? Are they doing enough to be considered Leaders? Are they Followers, still in the race, and trying to close the gap? Are they, perhaps, Laggards…desperately needing to look in the mirror and reconsider their activities in light of their strengths and weaknesses?

This year’s comparison and analysis has been tinged with the presence of COVID-19. How are companies reacting? Has it modified their plans? Majesco’s latest thought-leadership report, Strategic Priorities 2021: Despite Challenges, Leaders Widen the Gap, sheds light on how COVID-19 has negatively and positively impacted insurers and their plans for the future. We’ll share some key insights from Majesco’s report below.

Finding Opportunity and a Way Forward in a Crisis

We have seen the significant impact of the COVID crisis on the growth and strategic activities last year for all three segments; even the Leaders were not immune. But what distinguishes Leaders from the others is how much better they were prepared and responded to the crisis. Our research suggests the pandemic could be an inflection point that redefines every company in the industry – by pushing Laggards into further irrelevance, testing Followers to recommit to a new digital future, and providing Leaders a springboard to accelerate innovation, competitive differentiation and growth.

Leaders are able to take advantage of the unique conditions of the crisis that can create the springboard which sparks innovation. A recent article in MIT Sloan Management Review helps explain these unique conditions, highlighting there are “five interdependent conditions that characterize a crisis and boost innovation.”[ii]

- A crisis provides a sudden and real sense of urgency.

- Organizations can drop all other priorities and focus on a single challenge, reallocating resources as needed.

- Teams come together to solve the problem with a greater diversity of perspectives.

- The importance of finding a solution legitimizes what would otherwise constitute waste, allowing for more experimentation and learning.

- Because the crisis is only temporary, the organization can commit to a highly intense effort over a short period of time.

Leaders are undoubtedly viewing these conditions as an opportunity to seize a competitive advantage, which is reflected in their stronger optimism for the future compared to Followers and Laggards.

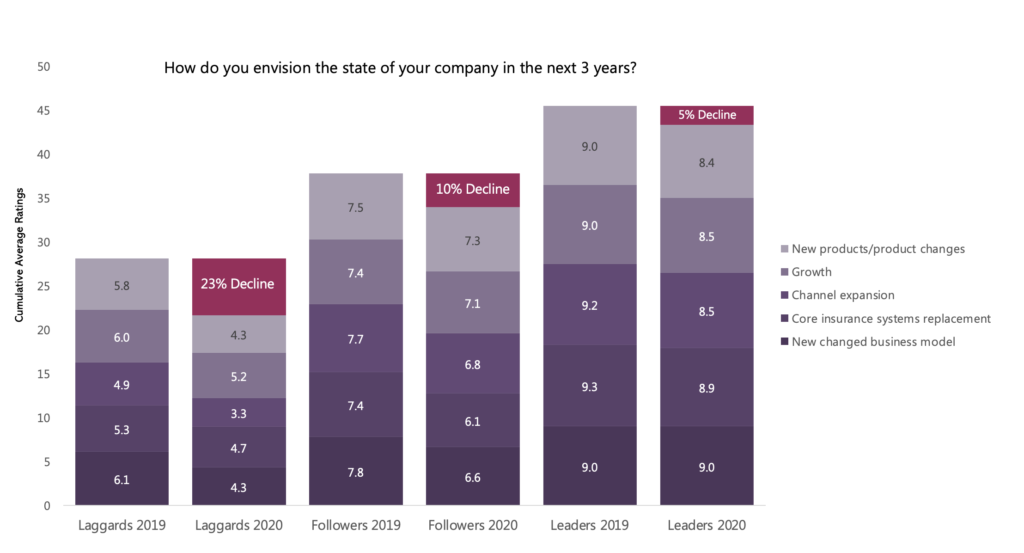

When assessing the outlook over the next three years, the impact of COVID is clear, as seen in Figure 1. Both Laggards and Followers have the same level of decreased optimism for the future as they had in the assessment of their companies’ growth and strategic activities in 2020 vs. 2019. However, Laggards also had nearly a 25% decline in their outlook for both last year and the next 3 years whereas Followers, while less, still showed smaller declines of 10% in both.

Leaders, on the other hand, show much more optimism. Despite a 5% decline in their future expectations compared to last year’s survey, this is less than half of the 12% decline in their assessment of their companies’ performance in 2020 vs 2019.

Figure 1: COVID-19’s impact on outlooks for company growth and strategic activities over the next 3 years

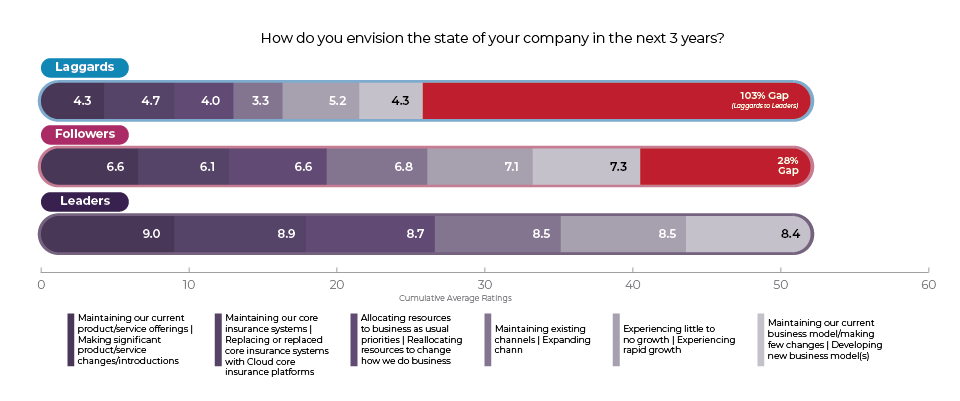

The most compelling result was a staggering, game-changing 103% gap between Leaders and Laggards in how they envision their companies over the next three years, a significant increase from the alarming 64% gap on their assessment of the past year (Figure 2).

While less, Followers’ 28% gap does not bode well for their future and contradicts earlier evidence suggesting they are keeping pace with the Leaders. While initial appearances may have been encouraging, digging deeper highlights that the breadth and impact of what Followers are doing is not enough for the future. The gap is slowly growing and with another crisis it could substantially impact their future. Given we have seen multiple major events or crises nearly every 4-5 years over the last two decades that have accelerated change – dot.com, 9/11, 2008 financial crisis, emergence of InsurTech and COVID – the likelihood is great!

Figure 2: Gaps between Leaders, Followers and Laggards in assessments of company growth and strategic activities over the next 3 years

Even more discouraging for these two segments is the continued growth in the gaps with Leaders in their optimism for the future. This is especially alarming for the Laggards, whose gap swelled by nearly 40 percentage points.

While not encouraging, Followers and Laggards must remember that every challenge has an opportunity or solution, some of which are incredible and give hope for an exciting, new future. They just need to proactively plan and execute on these to create an optimistic future.

Mirror, Mirror on the Wall

Instead of asking the famous quote by the evil queen in Snow White – “Mirror, mirror, on the wall — who’s the fairest of them all?” … Insurers should ask themselves “Mirror, mirror on the wall – am I a Leader, Follower or Laggard?”

This is where Majesco’s high-level analysis is meant to help answer that question. The most important analysis happens at the individual insurer level. Some form of introspection and analysis must occur within each insurer to confirm their locations within the realm of Leaders, Followers and Laggards. For a quick review, assess your own company against these definitions, below.

The Leaders: Companies that understand the market dynamics and have rapidly moved to planning and execution across most of the key areas. They are focused on a two-speed strategy by investing in modernizing and optimizing today’s business, while also investing in the future business nearly equally. They are or have moved from legacy or non-platform core to cloud platform core solutions, leveraging an array of platform, digital and emerging technologies to elevate customer experiences, launch new products, expand channels and embrace ecosystems to transform the business.

The Followers: Companies that understand the market dynamics but are not moving as quickly or broadly into the various areas for planning and execution. They are solidly focused on modernizing and optimizing today’s business, but less so than Leaders on the future business. While they are relatively close in many areas to Leaders, the pace of execution when looking out three years is not the same, meaning that the gap will steadily increase. Because of this, they may not recognize the danger in the gap until it is too late.

The Laggards: These are companies that generally understand the market dynamics but are clearly stuck in the past and have failed to rapidly move to planning and execution across the array of strategic areas. They are not moving to new cloud platform solutions, or incorporating platform and emerging technologies. They are keeping their business solely focused on the current business model, which lacks the level of automation, digital capabilities, and more, needed to meet the rising demands of a new generation of buyers. If not already, they are approaching a downward spiral of relevance that will be nearly impossible to reverse.

Because Leaders are so far ahead, their investment will be substantially less than Followers or Laggards who have waited, hesitated, or just moved too slowly. Playing catchup is expensive – both in outlay of resources but also in lost opportunities. The key is to confirm where you are, then never lose focus on it. Your organization deserves to know where it stands.

Fast-Tracking Transformations That Play to Your Strengths

The significant gaps between Leaders versus Followers and Laggards are becoming so great that there is a danger of Followers constantly trying to play catchup rather than their own game to win, and for Laggards entering an accelerating downward spiral. If you are still relying on the past and pre-digital age, pre-pandemic business models, now is the time to reevaluate.

It is time for bold moves. It’s time to skip some of the traditional steps involved in transformation and pull in support systems that will help your organization play to its strengths. It’s time to ask the hard questions to the Mirror on the Wall!

Majesco has designed a transformation model that artfully and efficiently combines your industry expertise with the digital tools and ecosystem supports you need to make the leap forward.

Begin by assessing where you are in the Knowing-Doing Gaps, from our Strategic Priorities research, that defines Leaders who are accelerating digital transformation with resilient digital business models. Rethink and reprioritize your strategies to take advantage of the shift and opportunities unfolding. And execute on these priorities with a sense of focus and urgency.

[i] Buckingham, Marcus and Curt Coffman, First, Break All the Rules: What the World’s Greatest Managers Do Differently, p.164, Simon & Schuster, 1999

[ii] Johnson, Elsbeth and Murray, Fiona, “What a Crisis Teaches Us About Innovation,” MIT Sloan Management Review, November 30, 2020, https://sloanreview.mit.edu/article/what-a-crisis-teaches-us-about-innovation/

The post Insurance Leaders Look in the Mirror appeared first on Majesco.

from Majesco https://ift.tt/3fzeFk4

Post a Comment

Post a Comment