March — the time of baseball preparedness with spring training and March madness basketball! Unbeknownst to us all, last March became the epitome of preparedness and madness due to COVID! As COVID-19 was applying increasing pressure to every industry, March Madness never got started and Major League Baseball’s Spring Training likewise was abruptly cancelled after the first game. I know because my husband who has been going for over 20 years to see his beloved St. Louis Cardinals in Florida was not happy and then we had to try to get a new flight home! Soon thereafter, baseball was overshadowed by concerns over logistics for the full baseball season. How would the games be played? Would fans attend? How could the schedule be changed to pull off a partial season?

This year, optimism is in full swing. March Madness is happening and speculation of the 64 teams is hot! At the same time, Spring Training started this week, with fans in attendance! Baseball may not be back to the old normal, but it will have fans, it will have a full schedule (162 games), and its return may be a sign of a new normalcy on the horizon. This means that 2021 Spring training is especially crucial to team performance. But what actually happens in Spring training? How does this preparatory period benefit each team? Is there anything the insurance industry can learn from a focused season of preparation?

Yes. More than anything, baseball’s Spring training is about constructing a strategy, organization, processes and technologies that will help the team win. Players hone their skills. Trainers and coaches tweak methods and models. The back office aligns the strategy and goals of winning with overall profitability. Everyone is charged with improving the fan experience, whether it is adapting the supply chain for concessions, installing a new digital scoreboard or reprioritizing and trading resources such as specific individuals needed to improve performance. Teams must prepare.

Insurers are just as much about winning as baseball teams. Today’s market is digital, customer-driven, and ecosystem/partnership enabled. They are challenged to put together a winning team to create growth and make a profit. They have similar questions to answer. Should we add the capabilities we need to capture the market? Should we reprioritize our resources to accelerate strategic initiatives? Can we focus and devote this season to preparing our organization for the partnerships, supply chains and ecosystems that will keep fans coming back?

Last month, Majesco released Part 1 of two 2021 Strategic Priorities reports. Like a big-league scouting report, Majesco has surveyed the players, the opportunities, the challenges and the surprises. We have taken a snapshot of industry trends as seen through the eyes of insurance executives. As a part of that report, we surveyed insurers on their level of partnership planning, piloting and rollout. Not surprisingly, we found a strong relationship between partnership and new products and channels — meaning that the insurers that are poised to win are those who have taken “Spring training” seriously.

“Partnering? There’s a gap for that.”

Competitive market position is about constructing an ecosystem that plays to your strengths and incorporates partners to fill gaps or weaknesses. Gone are the days when companies would think, “Anything you can do, we can do better.” Today’s mantras are, “Anything you can do, we might be interested in. Any market you reach might be good for us. Any tech advantage you might own, we might be able to use it to our advantage.” It’s all about doing more at speed!

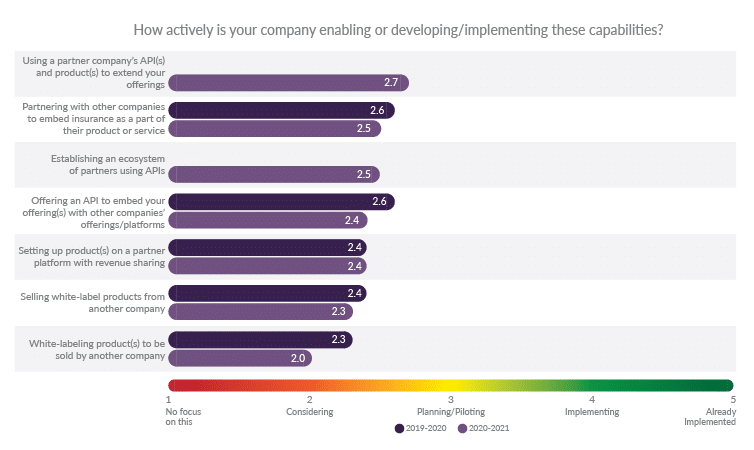

Last year’s Majesco Strategic Priorities survey revealed a relatively slow start in establishing partnerships and ecosystems, with more organizations thinking about it rather than planning, piloting or implementing. Unfortunately, we saw some backsliding on several partnering initiatives, perhaps driven by shifting priorities due to COVID, as seen in Figure 1.

Insurers must rapidly shift into a new gear to accelerate and avoid lost opportunities to reach new or underserved markets as well as to be at the front in establishing partnerships before others. Failure to recognize the criticality of partnerships and ecosystems is a major blind spot. Our research, as well as numerous other studies, have shown strong customer interest in buying insurance through other partnerships and channels. Furthermore, the development and access to APIs to connect to new partnerships and ecosystems is increasingly important for consideration.

It might help to look at just two examples of companies that have cultivated a partnering environment in order to fill their competitive gaps, planting new products in new markets and opening new channels for current products. For example:

- Chubb – Launched Chubb Studio “digital insurance in a box.” Partners can access their products, services and claims digitally and integrate what they do into what the partner does – embedded insurance. Initial products offered include: Health & Well-Being, Home Contents, Gadgets, Travel and Small Businesses.[i]

- Nationwide – Launched their Partnership Program for partners and developers to digitally provide Nationwide’s products (including auto, home, commercial, pet) on the same digital platform, making the partner experience “quick, easy and seamless.” It provides an integrated “front door” where companies can quickly enable a partnership with Nationwide.[ii]

Figure 1: Insurers’ levels of activity in adding partnership and ecosystem capabilities

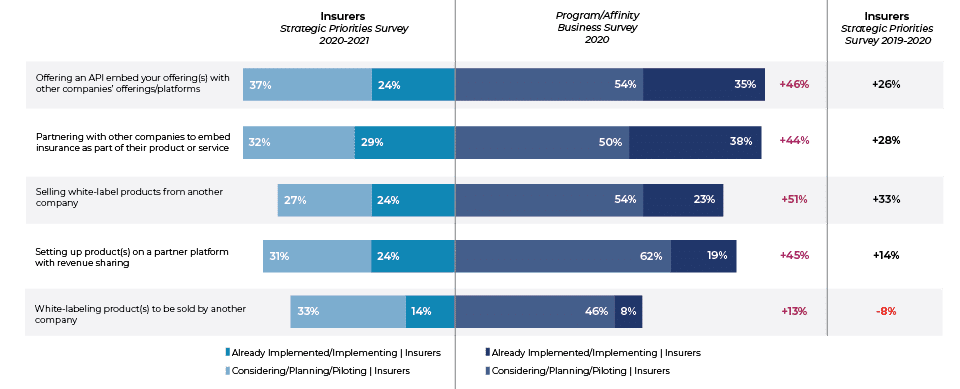

Our joint research report with PIMA, Navigating A New Era of Digital Technology and Customer Expectations, highlighted that companies involved in program and affinity business are well ahead of others in setting up and leveraging ecosystems and partnerships – moving from traditional to new, innovative relationships. Based on this year’s Strategic Priorities responses (Figure 2), the gaps between insurers with and without program/affinity business were significant and growing as compared to last year’s Strategic Priorities results – upwards of 40-50% gap difference!

Given the rapid development of ecosystems, the shift to a platform economy, and increased focus on a broader customer experience dependent on partnerships, these gaps offer those actively working with ecosystems and partnerships the opportunity to accelerate and tie down relationships while others lag behind and ultimately lose out on the opportunity.

Figure2: Levels of activity in adding partnership and ecosystem capabilities, gaps between insurers with vs. without program/affinity business

New Products and New Partners: A Match for New Markets

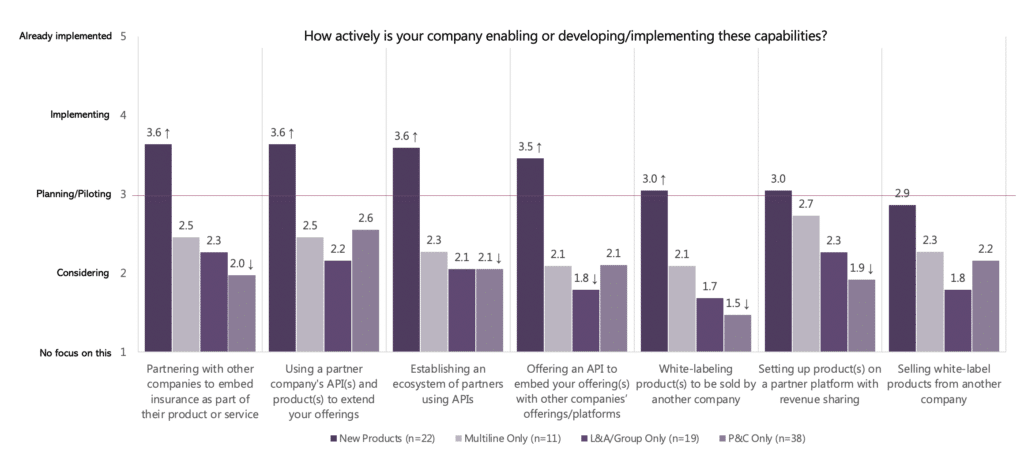

Not all insurer segments are finding it difficult to make partners and to capitalize on opportunities. Our research has found that insurers with New Products are blowing away their traditional product counterparts in leveraging partnerships and ecosystems, as seen in Figure 3. Multiline insurers are a distant second in most of these activities. Traditional P&C and L&A/Group segments appear to be resigned to traditional channels rather than expanding channel choice and reach. The challenge is that they will find limited opportunities for partnerships the longer they wait. This will limit, if not contract, their market reach and growth opportunities as a new generation of buyers increasingly turns to alternative channels.

The relationship between new products and new partners seems to indicate that creating a competency within new product development opens the doors to new partners, and makes it easier to craft customer-ready ecosystems. Here is where planning and training become extremely important.

Looking ahead, insurers that wish to compete across all current lines of business must bring their best planning to the table and introduce the tools needed to capture the opportunities. The enormity of the task can seem daunting, but in reality, it’s a mental game. Ecosystems of partners already exist. Ecosystems of insurance apps, services and APIs already exist. Majesco, in fact, has taken great care to curate these partners and ecosystems. All that is needed is the willingness to shift gears and an openness to new methodologies that will ultimately prepare the organization to shed technology debt and become responsive.

Figure 3: Levels of activity in adding partnership and ecosystem capabilities by lines of business

Regulatory Perceptions vs. New Rating Realities

Ask any insurance boardroom executive if regulatory issues constrain growth and 95% will say, “Absolutely.” Complex state regulations have traditionally been viewed as a barrier to the industry’s attempts to try new things and a barrier to new competition entering the market. But this is changing. Contrary to the common perception, regulators are taking steps to foster innovation and working with organizations who are bringing new products and business models to market. The shift is looking at regulators as partners working together as the industry shifts to a new digital era of insurance.

With the implementation of insurance innovation sandbox environments in many states, we now know that regulators realize the importance of innovation to meet the changing needs and expectation of their citizens whose interests they are pledged to protect. AM Best added fuel to the innovation imperative with the introduction of its Innovation Rating criteria. And many insurers who are developing new, innovative products are proactively working with regulators to guide and speed the process.

Yet most insurers have not yet picked up on the importance and impact of regulators as partners. Surprisingly, participation in a sandbox was particularly low among the P&C-only (average rating of 1.6) and L&A/Group-only (1.7) segments suggesting they are following traditional products and paths for approvals. The innovation practices to support the AM Best innovation criteria remained the same. This is actually surprising given the poor initial results of the Innovation Ratings AM Best published in March 2020. We can hope that 2021 will bring more focus and alignment.

Partners and Ecosystems: Inspiration for Insurance

We see big bets being made in new business models, products, and services from both InsurTech and incumbent insurer leaders who are “early responders,” capturing customer and market attention. Some of these companies emerged after the 2008 Financial Crisis or in the early stages of InsurTech, others are incumbents who made bold moves while others are outside industry players. Regardless, they serve as examples and inspiration for the types of bold moves the rest of the industry needs to make in order to compete and succeed in the future of insurance.

- Automotive Players: GM, Tesla, Volvo

- Outside Players: Petco, Intuit, Walmart, Credit Karma

- Industry Greenfields: Say Insurance, Spire, Haven Life

- Reinsurers: Munich Re, Swiss Re, RGAX

- Startups: Pie Insurance, Next, Lemonade, Root, Ategrity

- Embedded Insurance: Volvo, Wrisk, Mylo

- B2B2C Ecosystems: PingAn, Allianz, Nationwide, Chubb, AXA

- Membership/Subscription: BOXX Insurance, Zipcar

- On Demand Insurance: Starr Insurance, First Insurance Company of Hawaii

- Partnership and Ecosystem: Acko + Amazon, Nationwide + Toyota, Chubb + Hodinkee, Root/Lemonade/Ladder Life + Sofi

Change, as we have known it, has changed. It is faster, deeper, wider and more powerful than we’ve ever been used to before. Forward-thinking Leaders are making bold, warp speed moves with a two-speed strategy to optimize today’s business while simultaneously creating their future business. They are focused on next-gen platforms, ecosystems, new channels, new products and business models – all key strategies that influence and accelerate growth.

In this new era of insurance, leadership and understanding, the market shifts matter. Planning and execution matter. Speed matters.

Are you in a season of preparation for the future of insurance? Look at your strategic initiatives and see where you stand compared to Leaders, Followers and Laggards. Resolve to boldly reprioritize, pursue partnerships, reallocate resources and accelerate plans with a two-speed strategy to close the gap. Read about the latest trends among insurers in Majesco’s Strategic Priorities 2021: Part 1 report, then next week, be sure to download part 2, Strategic Priorities 2021: Despite Challenges, Leaders Widen the Gap.

[ii] Ben-Hutta, Gabriella, Nationwide launches Partnership Platform, December 14, 2020, https://coverager.com/nationwide-launches-partnership-platform/

The post Insurance Enters Partnership Preparedness Season appeared first on Majesco.

from Majesco https://ift.tt/3rmFhIc

Post a Comment

Post a Comment