In the year 2000, there were 10,000 banks in the United States. At the end of 2020, there were roughly 5,000. In 2021, at least 3 banks per week were closing or merging.[i] Insurers that wish to stay competitive should look at what is happening in the financial services sector.

Banks are being outmaneuvered. In some ways, they are losing their relevance. In other ways, they are simply losing business. Consolidation is on the rise for those who wish to remain competitive.

What has changed for bank customers? Savings accounts and CDs used to produce real interest. We used more checks drawn from our checking accounts. We used more cash. If we had a credit card, there was a high likelihood that it was affiliated with our bank. If we had a debit card, it was bank-issued. Technology, however, has revolutionized payments. We no longer need banks for savings or payments.

New payment channels are on the rise, driven by startups and Fintechs. They are disintermediating banks. The payment platform, Square, for example, offers a debit card to small business owners, allowing them to draw on funds collected by Square at the retail counter.[ii] The business owner’s primary channel of income has just become its fastest route to liquid capital. The bank? It’s no longer a necessity.

When we look at the other Fintechs, we see much of the same. You can keep funds in PayPal for online purchases. You can hold funds in Venmo for friendly transactions. You can send your paycheck to Robinhood, then spend and invest from within Robinhood. You can use Sofi (once a Fintech, now a bank) to manage all of your finances from college loans through fractional share investing and into retirement accounts.

Fintechs have reconstructed financial services outside of the traditional realm of financial services. They built ecosystems, connected APIs to digital partners, and quickly utilized technology to manipulate data.

There is a flip side. The largest banks still have healthy growth. They are adding the technologies and partners that are catapulting them into the consumer stratosphere. This competitive catapulting is available to insurers as well. In fact, Majesco’s own research (published in our recent report, A Seven-Year Itch: Changes in Insurers’ Strategic Priorities Defined by Three Digital Eras Over Seven Years) is proving that a massive gap is growing between Leaders, Followers, and Laggards in the two areas where insurers MUST compete — partnerships and data use.

Today’s tech is the ticket to competitive channels

Partner ecosystems are a competitive catapult. They will separate the leaders from the pack by sending them way out ahead, but they require technology as a strategic priority. A partnership is only as good as a partner’s capabilities. Insurers are the ones interviewing for positions as channel partners. To gain access to new markets, they must improve their tech and data resume and prove that they can meet new consumer trends.

Market boundaries are no longer relevant. Customers want to buy when and where and from whom they want. Technology is fueling customer expectations, altering, and expanding the traditional markets and channels through which insurance is sold, including automotive, transportation businesses, big tech, and more. This creates greater value for insurers and brokers due to new revenue streams and access to a broader market through the multiplier effect.

Yet, Majesco’s research is showing that in the last year, there are relatively few changes in the degree of activity for partnerships and ecosystems, remaining just below the “table stakes” level of planning/piloting. This continued “treading water” position increasingly creates lost opportunities to reach new or underserved markets, let alone establish key partnerships before others to position for market leadership.

Failure to recognize the criticality of aggressively establishing partnerships and an ecosystem now is a major blind spot.

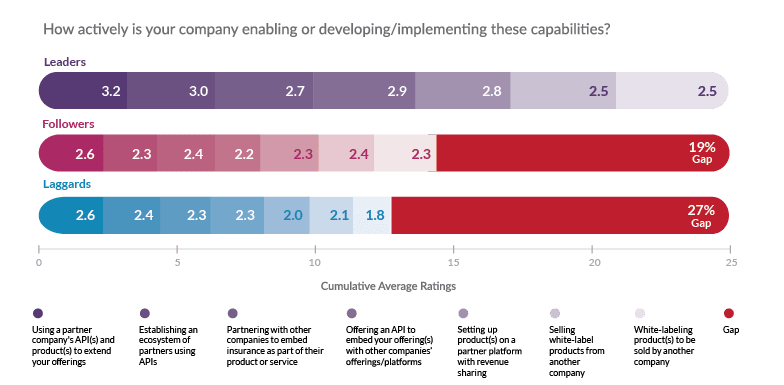

However, what is clear from our multi-year research is that the expansion of partner ecosystems is beginning to separate the leaders from the pack. The gaps between Leaders, Followers, and Laggards in embracing these activities are considerable at 19% and 27%, respectively (See Figure 1).

The three largest and most consequential gaps for Followers and Laggards are the use of APIs to extend offerings (24%), establishing an ecosystem of partners using APIs (28%, 31%), and embedding/selling offerings with other companies (25%, 32%). Laggards place themselves at a further disadvantage with significant gaps for the white-labeling product(s) to be sold by another company (39%) and setting up product(s) on a partner platform with revenue sharing (36%).

These gaps put Followers and Laggards at an increasing disadvantage with customers who are seeking to buy insurance from a wider array of entities as shown in our consumer and SMB research, with Millennials and Gen Z nearly all open to these channels, at 50% or more. The impact is loss of customers and revenue, leading to declining market relevance.

Large insurers are stronger in using APIs (average gap of 20%) and in partnering with other companies to embed their insurance products (8% gap). Access and use of APIs is foundational to effective partnerships and ecosystems, often limited by legacy technologies.

Figure 1: Levels of activity in establishing partnerships and ecosystems by Leaders, Followers and Laggards segments

Data & analytics may one day eclipse all priorities

Data and analytics capabilities are poised to be a game-changer for insurance. Coupled withnew and real-time data, advanced analytics and AI and machine learning, insurers can have a significant impact across the entire insurance value chain. From optimizing business processes to enhanced decision making, pricing, marketing, customer experiences, automated underwriting, claims management, and more, data and analytics are poised to help reimagine the insurance business model, products, and entire value chain.

The use of real-time data and analytics will help insurers stay on top of rapidly changing conditions. They provide insight for launching new services and they enable constant product refinement to meet changing needs and stay competitive in the market.

With the ever-increasing volumes of new, non-traditional data from IoT devices, geospatial, weather, unstructured sources, and more, leading insurers are realizing the importance of leveraging this data to stay ahead of competitors in the race to meet rapidly changing customer needs and expectations.

When it comes to partnering and plugging into partner ecosystems, most companies will need more than a functional API foundation. They must have effective data management that enables expanded analytics.

Data and analytics — prioritizing capabilities

Majesco’s report found that gaps between Leaders, Followers and Laggards and large vs. mid-small segments reflect a new breed of market leaders emerging.

Overall, across all segments, the first level of data maturity, consisting of operational reporting, business intelligence (BI) reporting, and the move to advanced analytics with predictive analytics, are firmly established capabilities. This is not surprising given this has been the focus over the last decade or more. However, the maturity shift to emerging analytics with machine learning and natural language processing is at or near table stakes status, reflecting the continued data maturity of the industry.

However, Leaders’ data maturity lead is emphasized with the sizable gaps compared to Followers and Laggards. Surprisingly, the gaps in baseline maturity capabilities of BI reporting (24%, 33%) are quite significant. Predictive analytics (21%, 24%) also shows large gaps. For both maturity levels, these gaps suggest the lack of continued investment in these capabilities and the challenges of legacy systems to effectively use the data. Given the gaps for the first two phases of maturity, it is not surprising that the largest gaps are in machine learning (36% each).

When looking at the differences between large and mid-small insurers, sizable gaps emerge. Large insurers remain well ahead of the mid-small insurers in advanced analytics, with predictive analytics (19%), and in emerging analytics, with machine learning (24%) and natural language processing (20%). This sets large insurers apart as data redefines a new generation of market leaders.

Figure 2: Levels of activity in building data and analytics capabilities by Leaders, Followers and Laggards segments

Data and analytics — functional priorities

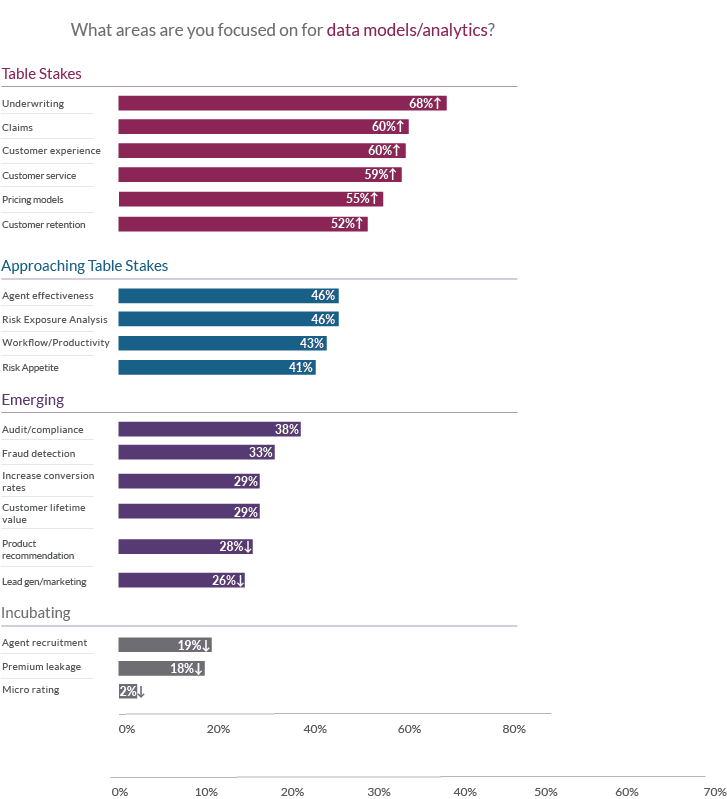

When looking at the use of data and analytics across the value chain, four different phases of use are reflected: table stakes, approaching table stakes, emerging, and incubating, based on their levels of usage, as highlighted in Figure 3 below.

Established table stakes areas reflect those that have traditionally leveraged data and analytics including underwriting, pricing, and claims as well as customer experience, service, and retention. Functional areas approaching table stakes include risk exposure analysis, risk appetite, agent effectiveness and workflow/productivity.

Figure 3: Data and analytics functional priorities

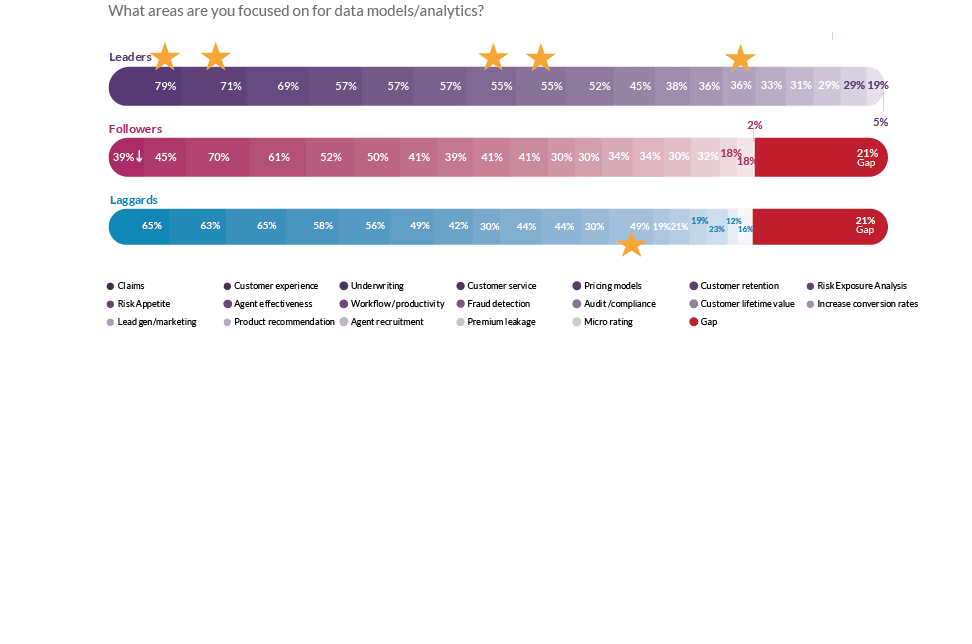

When looking at the difference between Leaders versus Followers and Laggards, the gaps are similar at 21%, but are driven by different relative weaknesses and strengths (See Figure 4). Laggards’ greatest gaps are risk appetite (25%), customer lifetime value (17%), and agent recruitment (17%), but they lead Leaders and Followers for Audit/compliance (13%, 19%). Interestingly, Followers are the weakest in claims (40%), customer experience (26%), and risk appetite (16%), all crucial areas to drive overall profitability.

Large companies led by double-digits in 15 of the 19 areas over the mid-small companies. Customer lifetime value (17%), customer retention (16%), agent recruitment (16%), underwriting (12%), product recommendation (11%), and premium leakage (10%) all show strong gaps that heavily influence product and overall profitability for insurers.

The old adage of “control what you can control” is now front and center for insurers as they look at new risk management strategies as a crucial component of their underwriting and customer service strategy. They are increasingly focusing their time and resources on how they can better assess risk and prevent losses to improve underwriting profitability and customer experiences.

Figure 4: Data and analytics functional priorities by Leaders, Followers and Laggards segments

Data — prioritizing sources

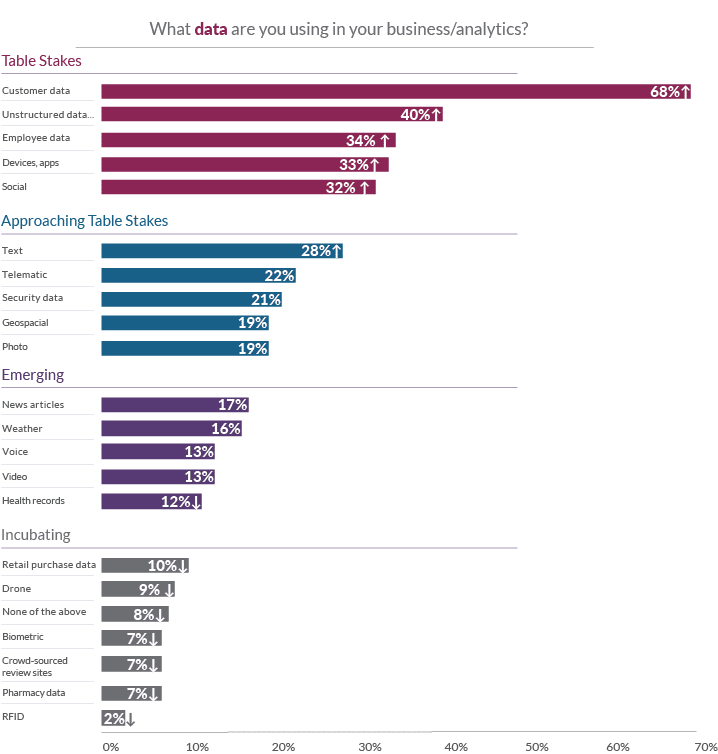

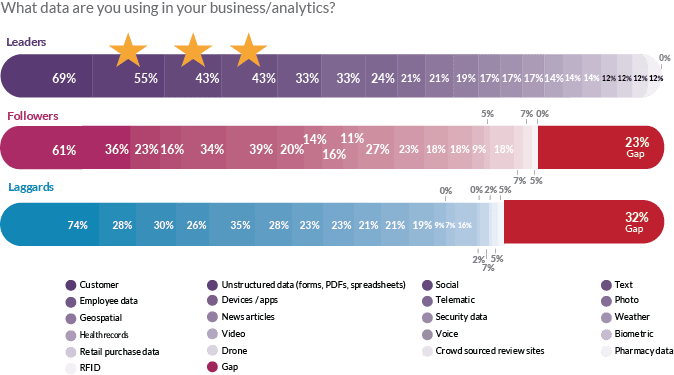

Similar to the functional areas where insurers are focusing their data and analytics efforts, the sources of data used are categorized into table stakes, approaching table stakes, emerging, and incubating, based on usage levels (See Figure 5). Overall results highlight that insurers are expanding the data sources from customer data to unstructured data such as loss runs and loss control reports to new digital data sources from devices, video, geospatial and more.

Figure 5: Data sources priorities

When comparing Leaders to Followers and Laggards in the use of these data sources, significant gaps of 23% and 32%, respectively, emerge (See Figure 6). Followers’ and Laggards’ most noteworthy gaps are in three areas: unstructured data (27%, 18%), social (13%, 20%), and text (17%, 27%). All except one of these data sources was used by at least 12% of insurers in the Leaders segment, which is a testament to their willingness to experiment with different data in their quest to optimize operations and stay ahead of the competition.

An increased focus on loss control has resulted in increased volume, variety, and velocity of structured and unstructured data sources. Loss control has moved from surveys with questions, checklists, and photos, to leveraging real-time data from smart devices, video, images of labels, and more, through risk engineering firms, customer self-surveys, and video-guided surveys. Insurers can use the richer data captured with advanced AI/ML for improved risk assessment, appetite analysis, underwriting, and pricing.

In this one area of Majesco’s research, mid-small insurers indicated similar levels of usage for 15 of the 22 data sources. However, they reported higher usage of text (32% vs 23%) and news articles (22% vs 11%) while large insurers indicated higher usage of devices/apps (38% vs 30%), weather (23% vs 11%), health records (18% vs 7%), drones (14% vs 4%), and biometric (13% vs 3%).

Figure 6: Data sources priorities by Leaders, Followers and Laggards segments

Advanced AI/ML enables insurers to analyze data in real-time to drive intelligent decision-making. By identifying hazards and providing recommendations as data is collected, insurers and vendors can now create more value by proactively addressing issues and providing recommendations in real-time.

This is the kind of competitive edge that insurers will need as customers seek their own value in the services that insurers provide. Insurers who are clear with customers about their abilities to prevent and protect — not just cover losses — will be those who catapult themselves forward with real value to individuals and businesses.

In today’s new insurance age, data is the fuel for innovation. New technologies, demographics, and behaviors are driving the explosion of data and will power the growth of new businesses and industries over the next 10 years. Many of these businesses will grow within completely new industry types, setting the stage for new insurance market expansion, products, and services.

How can insurance be different and better than other financial services? Insurers can, right now, look at their business models and how their technology either feeds or drains resources. Are advancements aligned to competitive plans? Do insurers know what new options are available to give them speed, flexibility, and the proper foundation for partnerships and data management?

Every insurer is different and unique. Does your organization have the initiative to compete, but you wonder how you can move from where you are to where you need to be? Compare your own strategic priorities to the priorities of the Leaders in insurance by reading A Seven-Year Itch: Changes in Insurers’ Strategic Priorities Defined by Three Digital Eras Over Seven Years, then contact Majesco to discuss how you can become an insurance technology leader of the future.

[i] Gran, Ben and Mitch Strohm, Can PayPal Serve as Your Bank Account?, Forbes, July 23, 2021

[ii] Bary, Emily, How debit cards are becoming a democratizing force, Marketwatch, October 4. 2021

The post Insurance’s Two Competitive Catapults: Partnerships and Data appeared first on Majesco.

from Majesco https://ift.tt/J9Te6gX

Post a Comment

Post a Comment