Competitive gaps aren’t normally the result of just one issue. They are a matter of dozens of little challenges that all add up to tremendous competitive pressure. COVID-19 has exacerbated many of the challenges that have been driving Leaders, Followers and Laggards further apart. Once the gap begins to grow, it’s tough to reverse momentum and close the gap.

Business with a Blindfold

The REAL issue, however, is that most insurers don’t know why there is a gap — there are so many factors to consider, many inter-related. Laggards may have a vague sense of what is holding them back. Followers may be trying to emulate or catch up to Leaders without a complete understanding of what it will take. Even Leaders may not hold the right perspective on what is keeping them ahead. It’s a dangerous spot to be in. Are insurers safely in the center of market demand, balanced with internal/external alignment, ready to capitalize on opportunities? Or…are they so far off center that they are standing on the edge of a cliff? Most executives would like to know where they stand.

Last week we began looking closely at how insurance innovation has been invigorated by the COVID-19 crisis. Insurers have been scrambling to respond, picking up the pace of business transformation planning and doing. Majesco’s latest thought-leadership report, Strategic Priorities 2021: Despite Challenges, Leaders Widen the Gap, carefully examines real levels of knowing, planning and doing among surveyed insurers. The goal of the report is for insurers to weigh their own organizations against those surveyed to uncover where they are on the spectrum and then to adjust their planning and priorities to take the necessary steps to become Leaders and to stay in the lead.

Gaining Perspective

The first step in successfully responding to change and disruption is awareness and appreciation of internal and external challenges and knowing where your organization stands on each one relative to critical internal (e.g. strategic objectives) and external (e.g. current competitors) reference points. Leaders reveal advantages over Followers and Laggards in their focus on internal and external challenges reflected in the sizable gaps revealed in our Strategic Priorities research.

Internal Challenges

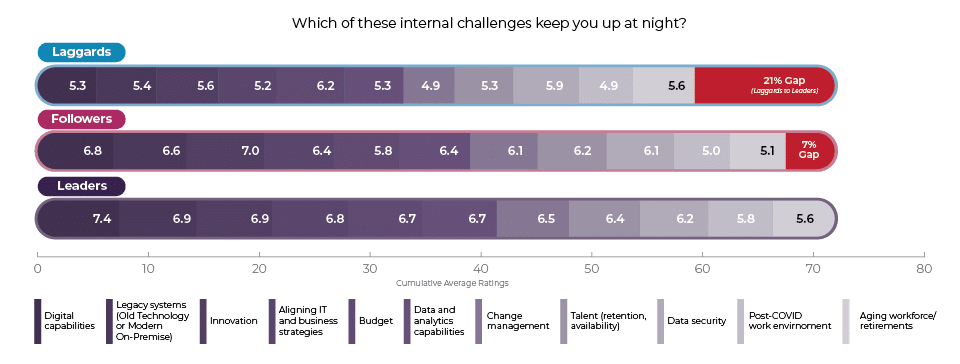

The 21% cumulative gap between Leaders and Laggards on 11 internal challenges was driven by large differences on several individual challenges, including Change management (41%), Digital capabilities (40%), Aligning IT and business strategies (31%), Legacy systems (28%), and Data & analytics capabilities (26%). Digital capabilities gap highlights the unpreparedness of Laggards for rapid change in a digital world, and one that increasingly makes them uncompetitive.

Interestingly, the two segments were identically aligned on Aging workforce/retirements, which was 10% ahead of Followers. This is not surprising given the significant legacy business processes, channels and systems dependent on those reaching retirement. The only other meaningful gaps, each at 16%, are in Post-COVID work environment (covered above) and Budget. Otherwise, Followers are generally keeping pace with Leaders with only a 7% cumulative gap. (See Fig. 1)

Figure 1: Gaps in levels of concern about internal challenges

Evidence of Followers’ concentrated efforts to keep pace or narrow the gap with Leaders over the past three years is evidenced in a big jump in the gap from 2018-19 to 2019-20, followed by the gap being cut by 50% this year. In stark contrast, the gap for Laggards on internal challenges nearly doubled.

Switching the Benchmark

Some insurers will look at these internal challenges and say, “Well, we know what our issues are. We just need to address those issues and we’ll move back into a competitive position.” It is not that simple. Unfortunately, it is the external issues that are driving much of the pressure and many insurers don’t completely understand how the external impacts the internal. Before we begin looking at the external pressures and how to close the gap, we should look outside of insurance for a moment at the concept of the benchmark.

In the world of investing, certain investments, such as mutual funds, use benchmark funds. The benchmark fund is a sort of mirror for mutual fund investing. If your fund beats the benchmark fund, it’s doing well. If it doesn’t match the benchmark, something might be wrong. But the two funds are normally very close in nature with an equivalent distribution across investment types.

But what if someone took one of your mutual funds and swapped the benchmark fund with an outrageously high performing fund that is focused on new market trends and demands and looked nothing like your fund at all? Would you disparage your efforts, or would you reassess your market focus and trade your investments in to find investments that look like the new, impressive benchmark?

This is essentially what is happening within insurance right now. The benchmarks that we have been using (familiar traditional competitors and similar companies within insurance) are becoming less relevant as growth indicators. There are new sources of competition in the market that are reshaping the business of insurance and have the potential to make our past investments look sub-optimal. Do we invest to hit outdated benchmarks, or do we wake up and recognize a new level of competition?

Acknowledging the potency of the new insurance benchmarks is what will spur insurers to make the investments that will close the gap. With that in mind, let’s look at the external challenge gaps.

External Challenges

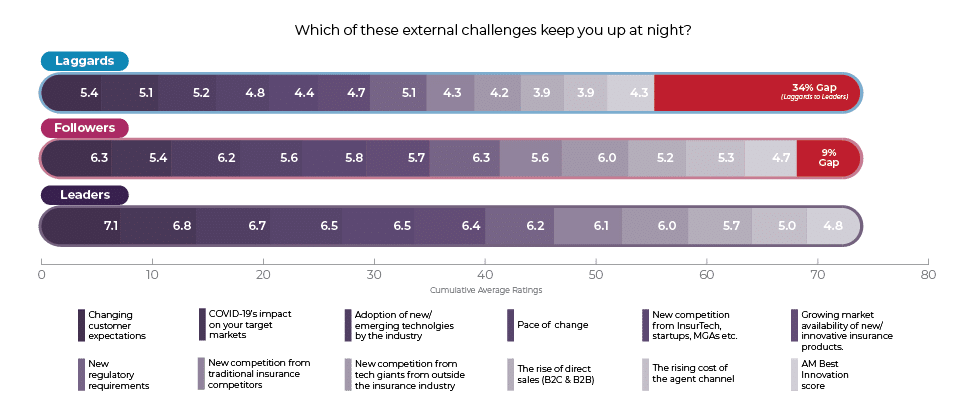

The gap between Laggards and Leaders is larger relative to external challenges (Figure 2). One of the largest gaps is around new sources of competition (new benchmarks!). This is a dangerous blind spot.

In particular, the gaps between Laggards and Leaders are nearly 50% for these four challenges:

- New competition from InsurTech, startups, MGAs, etc.: 48%

- The rise of direct sales (B2C & B2B): 46%

- New competition from tech giants from outside the insurance industry: 43%

- Increasing competition from traditional insurance competitors: 42%

Followers are more aligned with Leaders on these four, though are behind on New competition from InsurTech (12%) and The rise of direct sales (10%). In fact, their relatively small 9% cumulative gap to Leaders is somewhat obscured by an “averaging out” of small single-digit gaps on six of the issues, and slightly larger double-digit gaps on the other six issues, something we did not see in the internal challenges. The largest gaps for Followers suggest potential blind spots that must be addressed to keep pace with Leaders:

- COVID impact on target markets: 26%

- Pace of change: 16%

- Changing customer expectations: 13%

- Growing market availability of new/innovative insurance products: 12%

Figure 2: Gaps in levels of concern about external challenges

Despite this somewhat bifurcated set of external challenge gaps, Followers cut the gap with Leaders by nearly 50% compared to last year’s survey — likely recognizing new benchmarks! But, laggards continue to fall further behind as their gap to Leaders grew by over 50% from 22% to 35% over the past 3 years.

Game-Changing: Planning for a 2-Speed Strategy

Success in moving from the past to the future of insurance requires a two-speed strategy: Speed of Operations, which focuses on making improvements to the current, traditional business model with next-gen, mature systems and processes; and Speed of Innovation, which is all about creating agile, fast and new business models that explore, test and grow new business opportunities.

In Majesco’s report, we find that Leaders continue to distinguish themselves with a stronger focus on strategic initiatives that support both components of the two-speed strategy.

Speed One: Modernize and Optimize Today’s Business

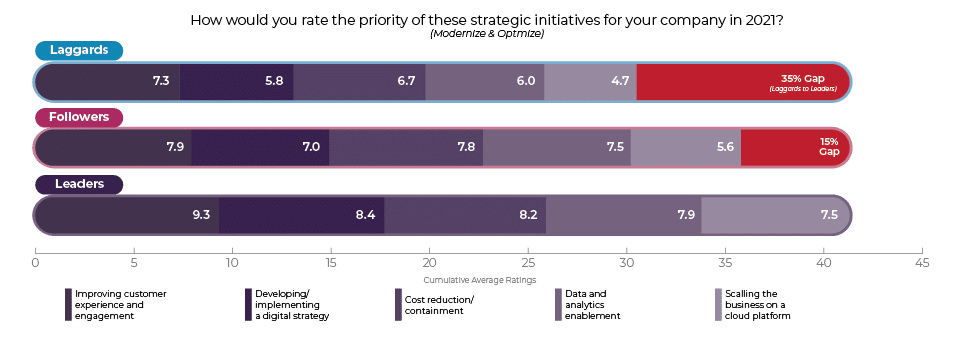

Drilling into the specific elements of Modernize and Optimize reveals a large gap of 35% between Leaders and Laggards. The two key drivers of this gap are Developing a Digital Strategy (45%) and Scaling the business on a cloud platform (60%). Surprisingly, Followers also have a sizable gap to Leaders on this last one of 34%, more than double the size of the overall gap of 15%.

The gap around cloud platform is of particular concern. In our new digital age, technology and the business are fundamentally inseparable. Cloud technology is now a given, APIs enable technology to be easily componentized, AI and ML help the business to make “smart” decisions, digital experience creates unique and personalized engagement, and no code / low code eliminates complexity and accelerates the digital transformation journey as we outlined in our report, Insurance Platforms – The Digital and No Code/Low Code Platform.

SMA has tracked cloud adoption over the past eight years. In their P&C Core Systems Purchasing Trends report, they noted that 2018 was a watershed year with three in four new core systems deployed in the cloud.[i] And in 2019 they reported that adoption hit a new high-water mark, with 84% of new core systems deployed in the cloud. They note that cloud is now a fundamental requirement in the digital world, and it is growing as we move into the new era of computing where every new technology trend, from AI and big data to microservices and the connected world, is increasingly dependent on cloud.

Figure 3: Gaps between Leaders, Followers and Laggards in Modernize & Optimize priorities

The Modernize and Optimize gap between Leaders and Laggards significantly grew from 9% to 35% over the past 3 years, continuing the theme we’re seeing of Laggards falling further and further behind. Leaders are constructing future-ready platforms. Followers are moving, but less quickly. Laggards are barely moving off of the status quo.

Speed Two: Create a New Business for the Future

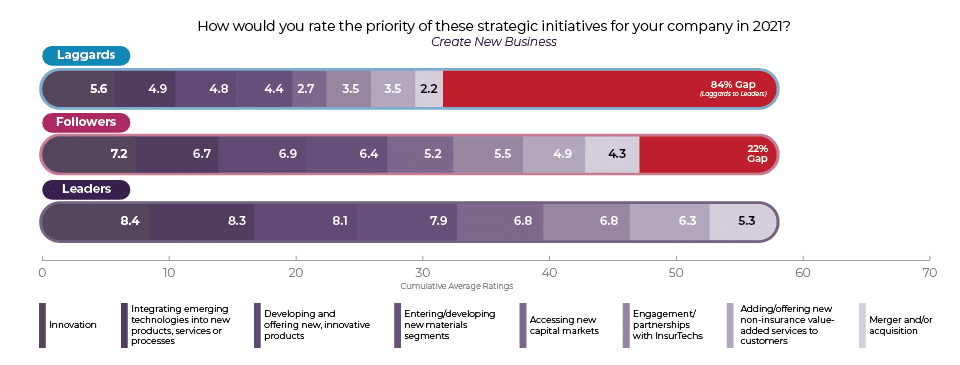

When we consider finding new benchmarks for our industry, it only makes sense that established insurers must respond to new, tech-savvy competitors by wielding innovative new business launches. When it comes to new business creation, Laggards fall drastically behind, with a massive gap of 84%! The gaps in the individual strategic initiatives range from a low of 50% for Innovation (which was a new addition this year) and 152% for Accessing New Capital Markets. The access to new capital markets is a challenge for many of the mutual insurers, limiting what they can do, particularly in an era of significant capital that is being invested in InsurTech and other digital, technology businesses.

Large gaps in Engagement/partnerships with InsurTechs (94%) and Adding/offering new non-insurance value-added services to customers (80%) are also strong evidence of Laggards’ shocking weakness in speed of innovation. This gap reflects their focus on the past, rather than the future – a dangerous blind spot that suggests dim prospects for continued relevance or survival. A quick re-focus and a two-speed business strategy is the only strategy that can close this gap because we need today’s business to be successful so that it can also fund the new business

Figure 4: Gaps between Leaders, Followers and Laggards in Create a New Business priorities

The differences in planning priorities between Leaders, Followers and Laggards stand out in Majesco’s research. While many Followers may be keeping relative pace to Leaders with their modernizing and optimizing the existing business, often reflected in strong financials, this is deceiving when considering the future business needed – where Followers and Laggards are not planning effectively, and are falling further behind.

Leaders continue to distinguish themselves from the other two segments with their stronger focus on strategic initiatives that support the two-speed strategy. The rest of the insurers must accelerate their planning and turn it into doing to remain relevant, let alone be viable for the future.

Is your organization pursuing a two-speed approach to modernization, optimization and innovation? Are you waking up to new benchmarks and realizing that something needs to change? Majesco Digital1stÒ Insurance is a cloud-based platform for rapid transformation and new business development. It meets mission-critical needs for digital customer engagement and improved digital ecosystem participation.

In our next blog, we go beyond Knowing and Planning to discuss actual implementation activity. How are insurers accomplishing a two-speed strategy that will accelerate digital transformation? Where are insurers lagging behind customer expectations? We’ll share new statistics on trends and technologies that are helping Leaders to become the new benchmarks for the insurance industry. For even more detail, download Strategic Priorities 2021: Despite Challenges, Leaders Widen the Gap.

[i] “P&C Core Systems Purchasing Trends: Foundational Technology to Fuel the Transformation Journey,” Strategy Meets Action, May 2019.

The post New Benchmarks and a 2-Speed Strategy to Close Competitive Gaps appeared first on Majesco.

from Majesco https://ift.tt/2NBub3y

Post a Comment

Post a Comment